Frosh announces Maryland part of settlement with Inuit over tax products

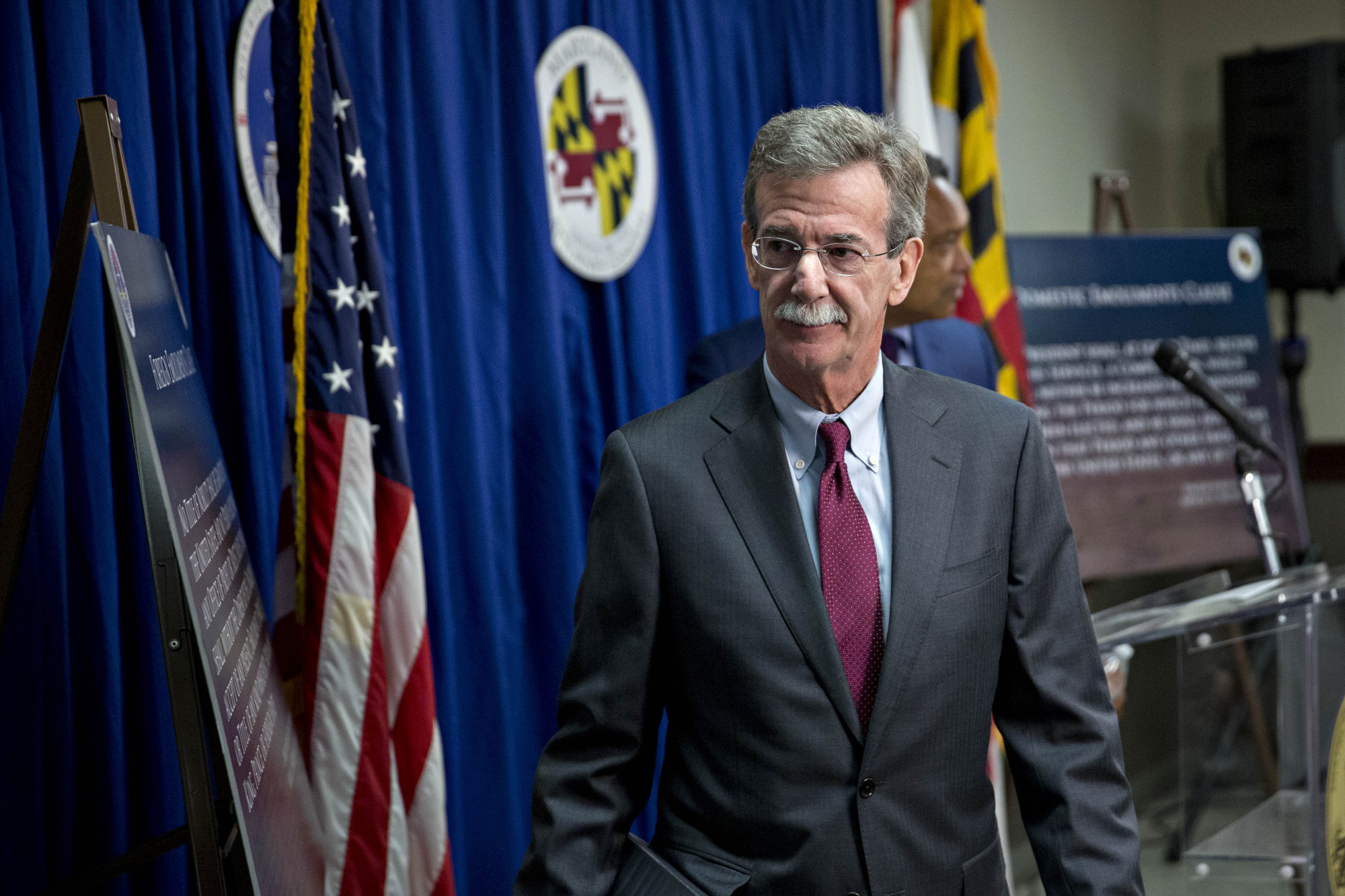

More than $2 million will be returned to Maryland residents from a settlement with Intuit, Attorney General Brian Frosh said.

The attorney general announced the agreement Wednesday stemming from a case that the TurboTax owner took advantage of state residents by deceiving low-income individuals into paying for what should have been free tax services.

“TurboTax lured potential customers with promises of free tax filing services, when it knew most of those customers would not qualify for those services,” Frosh said in the release. “Once those customers were hooked, TurboTax and its parent company, Intuit, converted those customers to another service for a fee. We are pleased that those customers who paid for services that they should have received for free will receive restitution as part of our settlement.”

The settlement, Frosh announced, will include more than $2 million in restitution as part of a multistate agreement where Inuit will pay $141 million to all 50 states and the District of Columbia.

The investigation began, according to the release, when ProPublica reported the company had utilized digital tactics that were used to guide low-income residents to commercial products. The move pulled those individuals away from “federally-supported free tax services.”

The company offers a free version of TurboTax, with one coming as part of a partnership with the Internal Revenue Service’s free file program. The initiative, a public-private partnership, allows taxpayers and members of the military earning nearly $34,000 to file their taxes for free using the company’s software.

According to the release, the deal featured and agreement that the IRS would not compete against Inuit and other companies offering tax preparation services, despite the government agency providing its services to taxpayers.

As part of the company’s advertising practices, the “Turbo Tax Free Edition” it is only free for those taxpayers who have simple returns. However, TurboTax in recent years marketed programs that were to be free as a selling point, but the product was only made available to one-third of American taxpayers for free.

The IRS, according to the release, says programs that are offered for free reached 70% of taxpayers.

Under the settlement, according to the release, Intuit will pay more than 66,000 consumers in Maryland for tax years 2016 through 2018 who were told they had to pay for the advertised “free” service.

The agreement stipulates Intuit must refrain from making misrepresentations with its products, enhance disclosures for marketing free products, and design its products to better inform users if they can file for free.

According to the release, consumers who are to be reimburses will automatically receive notices and checks by mail.

This article was originally posted on Frosh announces Maryland part of settlement with Inuit over tax products