Maryland delegate panel hears testimony on five tax relief bills

Members of a Maryland Delegate panel heard testimony on a range of tax relief bills that could impact such residents as disabled veterans and Centenarians, as well as people embarking on energy efficient upgrades.

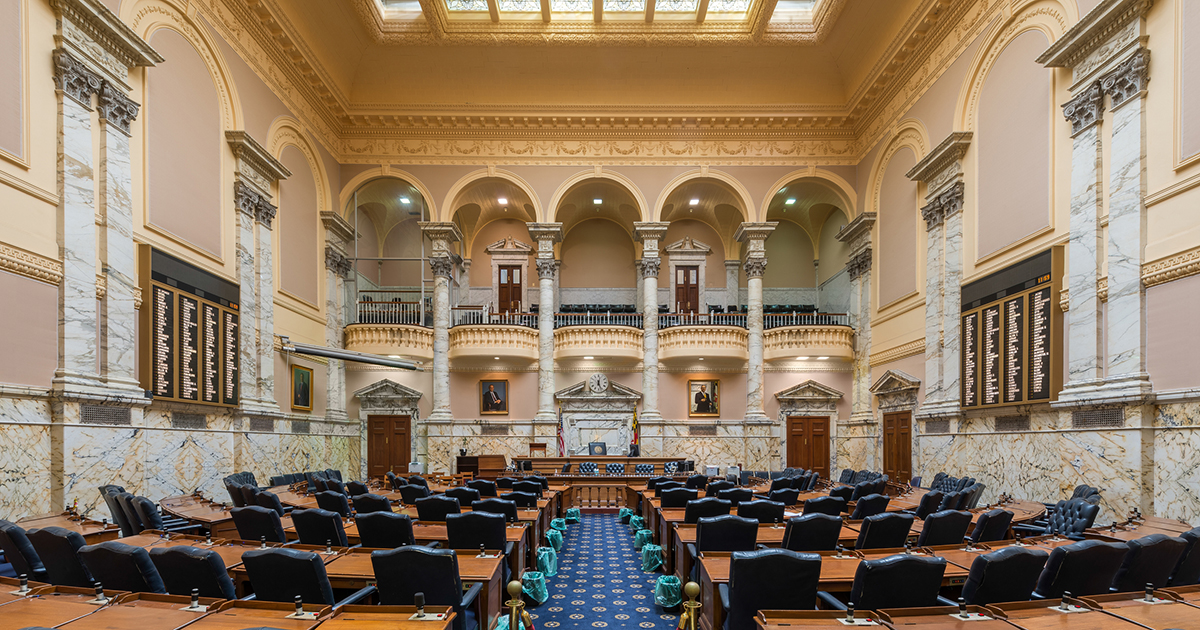

State Delegate Benjamin Brooks, D-Baltimore County, presented the House Ways and Means Committee with details on five bills, each touching on tax relief for specific purposes.

Brooks is sponsoring HB0058, which would provide a tax credit for energy efficient upgrades on so-called passive homes; HB0085, a healthy air quality tax credit; and HB0186, which would give income tax relief to state residents who are 100 year old and older.

Brooks also is sponsoring HB0103, which would provide a property tax credit to disabled veterans, and HB0124, which would provide a tax credit to veterans honorably discharged from service.

The bills remain in the hands of the Ways and Means Committee, and the Jan. 13 meeting served as an opportunity for the panel to take testimony on each one.

Most of the preliminary conversation from lawmakers, residents, business owners and advocacy groups was supportive of the various tax relief proposals.

John Van Horne, general manager of Baltimore-based Arundel Cooling and Heating Co. Inc., implored lawmakers to consider HB0085, which would provide a state income tax credit for some of the costs related to purchasing and installing indoor air quality equipment in residential, commercial, and industrial dwellings.

“In our work, we see air quality issues every day,” Van Horne said.

Of the five tax relief bills, HB103 generated the greatest amount of testimony. As proposed, governing bodies throughout the state could be required to grant tax credits to homes owned by disabled veterans.

“It is one way it will make their remaining years here a lot easier,” Brooks said of his rationale behind the bill.

Annette Garland, whose husband is a disabled veteran, said the legislation could benefit about 70,000 Maryland residents.

“Disabled veterans face more challenges than the average population,” Garland said.

Delegate Darryl Barnes, D-Prince George’s County, said he appreciated the proposed legislation – citing his own military background – but though a deeper review was necessary.

“I’m sympathetic to what you’re trying to do here,” Barnes said. “But let’s sit back and try and have another conversation.”

HB0186, the legislation tailored to Marylanders who turn 100, also garnered input from a representative of one outside organization.

As proposed, the bill would provide an income tax credit of up to $50,000 for residents aged 100 and up. According to reports, Maryland has about 800 residents at the Centenarian mark. About half are filing income tax statements.

Tammy Bresnahan, director of advocacy with the Maryland chapter of AARP, said the organization viewed the legislation as a gesture of goodwill.

“Living to 100 is exceptional, and it’s something that AARP does try to honor,” Bresnahan said. “To live to 100 is a phenomenal achievement for anyone.”

This article was originally posted on Maryland delegate panel hears testimony on five tax relief bills